Finance is a product of modern economics, which studies value judgments and value laws. Its academic fields include banking, securities, insurance, and trusts, and finance can be divided into microfinance and macrofinance. Traditional research areas in finance generally focus on two directions: macro-level theories of financial market operations and micro-level theories of corporate investment.

For applicants to finance programs, what backgrounds are most favored by top schools?

Taking the London School of Economics and Political Science (LSE) as an example, applicants for the Master's program in Finance need to have obtained a Bachelor's degree from a UK university or its equivalent overseas. Applicants should have a background in finance-related fields such as accounting, economics, business, mathematics, etc., with additional relevant work experience being advantageous. An average grade of 85% or above is required, along with a GMAT score of 650. In terms of language proficiency, a TOEFL score of 100 or an IELTS score of 7.0 is required.

For students interested in applying to popular majors such as finance, financial mathematics, or quantitative finance, institutions have specifically designed research projects to enhance the background of those aiming for higher education. Participating in cutting-edge research projects allows students not only to gain relevant academic experience but also to accumulate practical experience, enhancing their competitiveness in applying to top universities!

🏫 Topic: Finance Research Project: Deconstructing the Financial Mathematics Applications in Quantitative Investment Strategies - Constructing Trend Following Models and Investment Trading Strategies Using Mathematical Backtesting and Mean Reversion

📚 Relevant Majors: Finance, Financial Mathematics, Quantitative Finance

👫 Target Applicants: High school students, university students

🔢 Class Size: Around 15 students

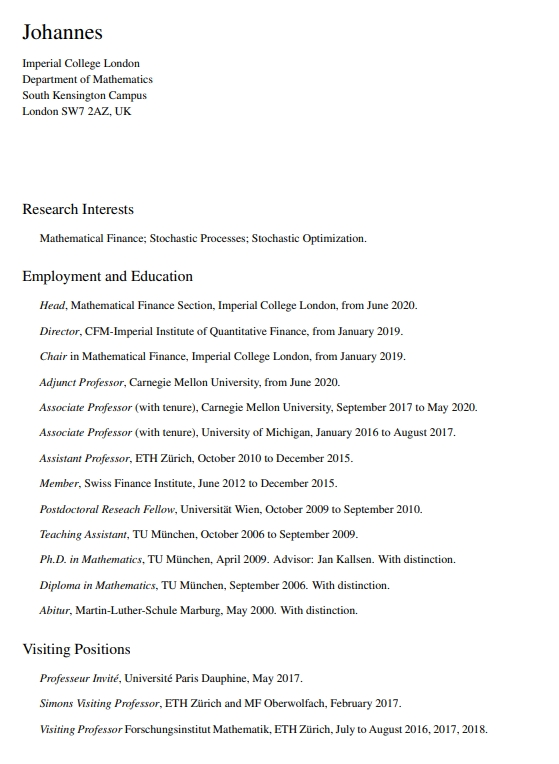

Lecturer: Imperial College London Tenured Professor Johannes

Johannes currently serves as the Director of the Financial Mathematics Program at Imperial College London and is responsible for the development of the CFM-Imperial Institute of Quantitative Finance project. This project, jointly established by Imperial College London and CFM Corporation, aims to promote interdisciplinary research focusing on the complexity of financial markets, quantitative modeling, and financial risk management.

Before teaching at Imperial College, Johannes taught at Carnegie Mellon University and the Swiss Federal Institute of Technology Zurich (ETH Zurich). Carnegie Mellon University's quantitative finance program consistently ranks among the top three in the United States, while ETH Zurich is a world-renowned top-tier science and technology university, also known as Einstein's alma mater, ranked 8th globally by QS in 2022. Thanks to his excellent teaching skills, Johannes's students have achieved significant success in various industries. One of his Chinese students, Fei, secured an assistant professor position at Columbia University in the United States with outstanding academic achievements, while another Chinese student, Ren, obtained a senior position at Credit Suisse (Fortune Global 500) after rigorous selection.

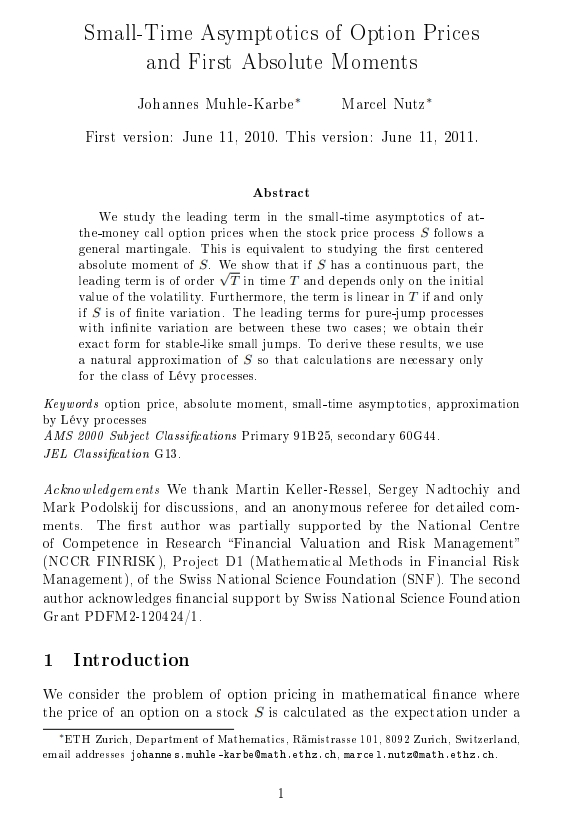

It is no exaggeration to say that Professor Johannes is one of the most authoritative professors in the field of financial mathematics. Johannes's research interests focus on mathematical finance, stochastic processes, and stochastic optimization problems. He has published over 40 papers in relevant professional journals, including top journals in financial mathematics such as "Mathematical Finance" and "SIAM Journal on Financial Mathematics." Moreover, Professor Johannes serves as associate editor for several top journals, including "Annals of Applied Probability," "Applied Mathematical Finance," "Frontiers of Mathematical Finance," "the International Journal of Theoretical and Applied Finance," and "Mathematics and Financial Economics." Professor Johannes has authored several books, some of which have been reprinted multiple times, including the latest "A Leland Model for Delta Hedging in Central Risk Books" in 2022 and the reprinted "Closed-Loop Nash Competition for Liquidity" in 2021.

Mentor Resume

Research Overview: This course is a core course in quantitative finance investment management. We will first analyze existing methods for quantitatively evaluating trading strategies, including evaluations of the strategies themselves and comparisons with overall market benchmarks. Then, we will discuss how to adjust trading strategies through backtesting using historical and simulated data, and explore how to avoid common pitfalls such as lookahead bias and data mining. These methods will be illustrated and cited through some commonly used trading strategies in practice.

Starting with passive index tracking as a benchmark, we will discuss systematic factors such as "value" (comparison of market prices to "fundamental value" estimates), "momentum" (betting on mean reversion trends), and "size" (systematic differences in performance between small and large companies). Additionally, we will discuss how many trading strategies obtain premiums by providing "liquidity," such as profits from trades that could not be executed independently but are realized through accompanying trades.

These tools and concepts will be further developed in the project section of the course, where students will implement and test trading strategies using real data. Upon successful completion of the course, students will be able to analyze and design a range of typical trading strategies.

Target Audience:

✅ Students interested in finance, financial mathematics, and quantitative finance

✅ Students aspiring to pursue majors in finance

✅ Students who want to learn academic writing, practice academic language use, and enhance academic skills

✅ Students willing to engage in scientific research, produce academic research reports, and papers

✅ Students hoping to delve deeper into the field, cultivate academic thinking, and enhance soft academic background

Project Arrangement:

1. Project Duration:

7 weeks of online group research learning + 5 weeks of flexible paper guidance learning, totaling 125 hours

2. Project Outline:

Alpha and Beta Strategies - Linear Factor Models

Risk-Return Measures - Backtesting

Portfolio Deconstruction

Quantitative Trading Strategy Practice Analysis

Academic Discussion 1: Professor discusses and evaluates the feasibility of personalized research topics with each group of students, helping students clarify their subsequent research ideas

Academic Discussion 2: Professor provides personalized guidance based on the progress of each group, ensuring high-quality final project output by students

Project Presentation

Project Output:

● Recommendation Letter

Research Project Recommendation Letter

Outstanding students may obtain EDU recommendation letters from renowned professors

● Paper Publication

Paper writing and publication guidance:

Submission and publication guidance for full papers to international conferences indexed at the level of EI/CPCI (applicable for applications)

Participation in international academic conferences (students are encouraged to attend in person or remotely)

● Research Project Materials

Research completion certificate

Academic reports

Professor evaluation form/letter

Application Assistance:

Before participating in the research project: lack of depth in resume

After participating in the research project: enriched resume, increased probability of successful application for further studies or employment

Before participating in the research project: clichéd application essay statements

After participating in the research project: accumulate high-quality application materials, create personalized application stories, demonstrate background soft skills

Before participating in the research project: unable to adapt to the study pace of prestigious universities

After participating in the research project: solidify foundation, stay ahead with rich experience and cutting-edge thinking

Student Cases:

T Student, George Washington University, GPA: 3.54

Participated in research project: Business Analysis Topic: Big Data Business Case Analysis

Received a Master's offer in Finance from Johns Hopkins University

W Student, International High School in Wuhan, IELTS: 6.5

Participated in research project: Financial Management and Accounting Topic: Regulation and Governance of Accounting Information Disclosure of Listed Companies

Received a Bachelor's offer in Accounting and Finance from the University of Edinburgh

After reading the introduction to the research project and student cases, let's now introduce the employment directions and rankings of institutions in the field of finance.

Hope this provides valuable reference for those preparing for further studies:

Institutional Employment Directions:

The employment prospects for finance majors are broad, with graduates being able to work in related positions in banking, insurance, securities, fund management, commodities, credit, and asset management industries. There are also opportunities to enter government agencies and institutions such as the National Bank, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the Tax Bureau, and social security institutions through civil service examinations.

Institutional Rankings:

1. Harvard University, United States

2. Massachusetts Institute of Technology (MIT), United States

3. Stanford University, United States

4. University of Oxford, United Kingdom

5. University of Chicago, United States

6. University of Cambridge, United Kingdom

7. London School of Economics and Political Science (LSE), United Kingdom

8. University of Pennsylvania, United States

9. University of California, Berkeley, United States

10. New York University, United States

no comments

To post a comment you must firstlog in